A: Please click the picture or open the picture in the new window to display the whole Expected Monetary Value (EMV) diagram.

Please click the link to download the source file.

http://www.box.net/shared/6nuvj8nxqj

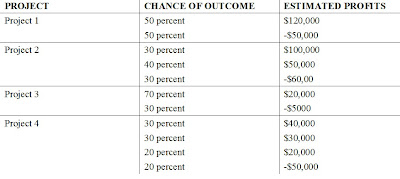

The EMV for Project 1 is:

0.5×120000 + 0.5× (-50000) = 60000 - 25000 = $35000

The EMV for Project 2 is:

0.3×100000 + 0.4×50000 + 0.3× (-60000) = 30000 + 20000 – 18000 = $32000

The EMV for Project 3 is:

0.7×20000+0.3×(-5000) = 14000 – 1500 = $12500

The EMV for Project 4 is:

0.3×40000+0.3×30000+0.2×20000+0.2×(-50000)= 12000 + 9000 + 4000 – 10000 = $15000

As Schwalbe (2006, p.449) indicated, “Because the EMV provides an estimate for the total dollar value of a decision, you want to have a positive number; the higher the EMV, the better.” In terms of this, I evaluate each project’s EMV first. All projects’ EMVs are positive, it’s great. But I want the highest profit, so I choose the project which has the highest EMV to bid on. The EMV for Project 1 is the highest ($ 35,000). Accordingly, I would bid on the project 1.

To be a good project manager, I should try to balance the risk and profit, which means I will try to find the best balance point (in my opinion) between the risk and profit. From the EMV diagram, we could find:

For project 1, we have 50 percent chance to earn $120,000, and 50 percent chance to lost $50,000;

For project 2, we have 30 percent chance to earn $100,000, 40 percent chance to earn $ 50,000, and 30 percent chance to lost $ 60,000;

For project 3, we have 70 percent chance to earn $20,000, 30 percent chance to lost $ 5,000;

For project 4, we have 30 percent chance to earn $40,000, 30 percent chance to earn $30,000, 20 percent chance to earn $20,000, and 20 percent chance to lose $ 50,000.

If we just looked the potential outcome of these projects, project 1 is the best, since we could earn $120,000 (50 percent chance) from it. If we just looked the potential risk of these projects, project 3 is the best, since we maybe only lost $5,000 (30 percent chance). However, I would like to bear the risk and pursue the biggest profit. The risk of project 1 is positive risk which could give us plentiful repayment. Therefore, I still would choose the project 1 to bid on.

Normally, just as Schwalbe (2006, p.449) said, “Using EMV helps account for all possible outcomes and their probabilities of occurrence, thereby reducing the tendency to pursue overly aggressive or conservative risk strategies.” A good project manager should consider both of EMV information and personal risk tolerance to make the decision.

Reference

Schwalbe, Kathy, 2006, “Information technology project management 4th”, Thomson Course Technology, a division of Thomson Learning, Inc.

No comments:

Post a Comment